Last Updated MAY 2024

How ESG Drives Employee Satisfaction in the Modern Workplace

In this post, we'll cover:

- » Deciphering the ESG Framework

- » The Link Between Sustainability and Employee Satisfaction

- » Empowering ESG in Your Organization

- » Measuring Your Impact

- » Five ESG Trends to Keep an Eye On

In the dynamic landscape of corporate responsibility, environmental, social and governance (ESG) factors have emerged as game-changers. No longer confined to shaping investor perceptions, they now wield considerable influence in enhancing employee satisfaction within modern workplaces.

This evolution signifies a profound transformation in corporate culture, redefining the traditional employer-employee dynamic into a more socially conscious partnership.

Studies show that employees working for companies committed to robust and enduring corporate social responsibility initiatives are 15.6x more likely to view their company as a great place to work and nearly twice as likely to take pride in their organization.1

Let's delve into the symbiotic relationship between ESG initiatives and employee satisfaction, exploring how businesses can create environments that not only attract and retain top talent — but also contribute positively to the communities they serve.

Deciphering the ESG Framework

Within the realm of corporate accountability, ESG — environmental, social and governance — serves as a pivotal framework guiding responsible business conduct:

- Environmental: Examining a company's ecological impact, advocating for sustainable practices that mitigate environmental harm and align profitability with environmental stewardship.

- Social: Focusing on a company's interactions with stakeholders, including employees, customers, suppliers and communities, emphasizing diversity, inclusion and human rights to foster a positive social footprint.

- Governance: Serving as the foundation for effective decision-making and risk management, encompassing internal controls and procedures that ensure transparency, accountability and alignment with stakeholder interests.

By integrating these pillars, companies can navigate complexities, drive financial performance and contribute meaningfully to a business ecosystem that is sustainable, equitable and ethical.

The Link Between Sustainability and Employee Satisfaction

Today's employees are seeking workplaces that resonate with their personal values, moving ESG beyond corporate jargon to a fundamental aspect of organizational culture.

Deloitte's Millennial Survey shows that over half of respondents prioritize environmentally sustainable employers post-pandemic, reflecting a broader trend toward ethical alignment in the workplace.2

Research from IBM further highlights the connection between ESG initiatives and employee satisfaction. Results show that 67% of respondents indicated they were more willing to apply for jobs with environmentally sustainable companies — and among those who had changed jobs in the last year, almost 1 in 3 accepted a lower salary to work for a more socially responsible or sustainable organization.3

When employees perceive their work as contributing to a greater societal good, it enhances their sense of purpose and job satisfaction beyond financial compensation.

Organizations prioritizing ESG also tend to foster cultures centered around innovation and collaboration, creating a positive work environment that promotes employee engagement and productivity. Sustainability efforts not only benefit the planet, but also play a crucial role in fostering a satisfied and motivated workforce.

Empowering ESG in Your Organization

To integrate ESG principles into your workplace culture, you should engage everyone — from entry-level to top executives, customers, suppliers, and the wider community you impact. Initiate meaningful discussions using tools like surveys, which offer invaluable perspectives from stakeholders across your ecosystem.

Here's a roadmap to embed ESG values into your organization:

Establish a Clear Vision: Define SMART goals focusing on areas within your control, ensuring each effort directly propels these specific objectives forward. Clear direction and measurable outcomes keep your workforce driven and focused.

Foster Collective Commitment: Ensure every level of the organization comprehends and commits to these overarching goals. Help individuals understand their direct contributions to the bigger picture, fostering a sense of ownership and accountability.

Measure and Report Regularly: Establish a baseline to monitor progress over time effectively. Choose measurable, science-based goals to establish a tangible link between your efforts and outcomes, ensuring your improvement journey is transparent and quantifiable.

Harness Stakeholder Feedback: Gain insights from employees and the communities you impact to be sure you are creating ESG initiatives that are not only meaningful, but yield substantial results.

Measuring Your Impact

Evaluating your organization's ESG performance is essential for demonstrating a commitment to environmental and social responsibility beyond financial success. Establishing clear metrics and consistent monitoring facilitates progress tracking, identifies areas for improvement and communicates tangible results to stakeholders.

So, how do you measure your impact?

ESG performance is gauged through both quantitative and qualitative indicators. These metrics encompass aspects such as carbon emissions, water usage, employee turnover rates, board diversity and executive compensation.

Before delving into specific metrics to use, it's crucial to note that some criteria are inherently easier to measure, like CO2 emissions. However, the value lies not just in developing precise measurements, but in understanding the cause and effect behind these numbers. That way, you can ensure your ESG initiatives are both impactful and actionable.

Consider the following key ESG metrics:

Environment:

- Reducing greenhouse gas emissions

- Mitigating air pollution

- Optimizing energy use

- Maximizing water utilization for efficiency

- Enhancing recycling and waste management

- Decreasing carbon footprint

- Promoting sustainable utilization of natural resources

- Adopting ESG initiatives such as forming a climate oversight board

Social:

- Ensuring fair compensation relative to cost-of-living expenses

- Advancing diversity, equity and inclusion (DEI) efforts

- Addressing gender pay disparity

- Enhancing employee engagement (e.g., Net Promoter Scores)

- Investing in professional development through reskilling and training

- Prioritizing health and safety protocols

- Strengthening cybersecurity measures

- Supporting charitable endeavors

- Promoting equitable supply chain practices

Governance:

- Enhancing board composition through diversity, skills and independence

- Protecting shareholder rights against unsolicited control attempts

- Improving investor relations for effective stakeholder communication

- Managing conflict of interest (COI) with robust policies

Five ESG Trends to Keep an Eye On

As the spotlight on environmental, social and governance (ESG) factors intensifies, organizations are navigating a rapidly evolving landscape. Let's explore five key ESG trends reshaping decision-making across industries.

Growing Interest in ESG Engagement

Investors are observing an increasing interest in ESG factors influencing clients' investment choices. Similarly, employees are also attracted to companies that prioritize robust ESG standards. This reflects a broader societal shift toward sustainability and ethical business practices.

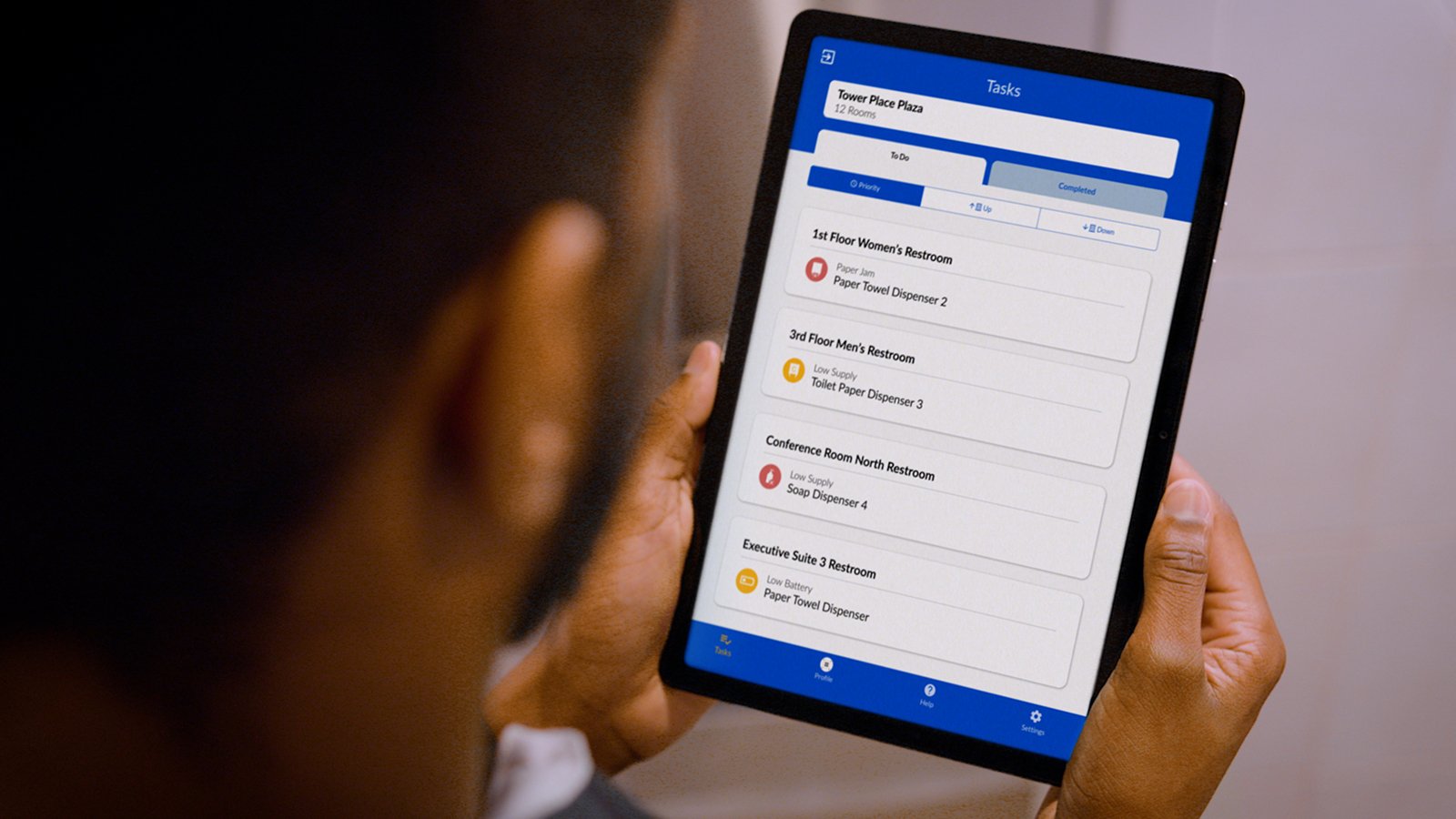

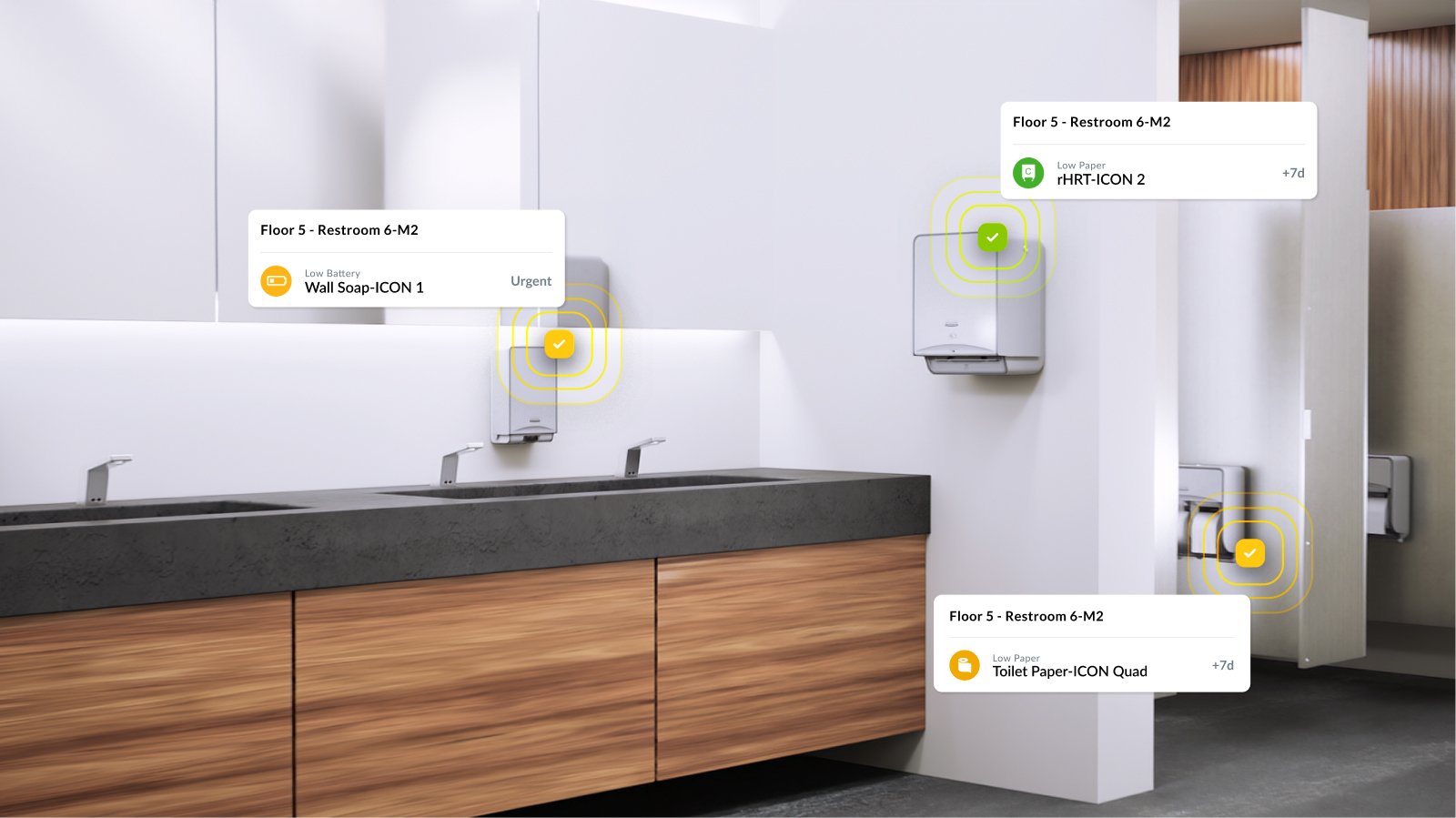

Harnessing AI for ESG Insights

With artificial intelligence (AI) technology, organizations can access valuable ESG data, enhancing decision-making and identifying growth opportunities. Continuous data monitoring also enables organizations to identify trends so they can swiftly adapt to market changes and meet stakeholder expectations.

ESG Shifts to the Private Sector

Sustainability reporting is expanding to include private companies, driven by Scope 3 regulations. This requires organizations to track indirect emissions within their supply chain, including those from third-party vendors. Because of this expect to see improvements in greenhouse gas emission calculations across organizations of all sizes.

ESG and Finance are Intrinsically Linked

Sustainability is becoming increasingly integrated into the financial fabric of companies. Nearly a third of CFOs are evaluating the financial implications of climate change, and many organizations are appointing ESG controllers — specialists responsible for incorporating ESG considerations into operational processes and financial reporting standards.4 This merging of sustainability with finance and strategy reflects a growing acknowledgment that sustainability and financial health are interconnected.

ESG Is a Necessity in the Modern Workplace

Incorporating ESG factors into the workplace signifies more than just a corporate trend, it reflects a fundamental change in the values and expectations of today's workforce. For business leaders, prioritizing ESG practices is crucial for showcasing a dedication to sustainability and creating a workplace where employees feel fulfilled, engaged and purpose-driven. Recognizing the significant connection between ESG and employee satisfaction enables organizations to pave the way toward a more fulfilling, sustainable and prosperous future.

2“2023 Gen Z and Millennial Survey.” (2023). Deloitte https: //www2.deloitte.com/content/dam/Deloitte/si/Documents/deloitte-2023-genz-millennial-survey.pdf

3Hastwell, C. (2023, December 13). “Workplace ESG: How Environmental, Social, and Governance Factors Impact Employee Experience.” Great Place To Work https: //www.greatplacetowork.com/resources/blog/workplace-esg-environmental-social-governance-employee-experience

4CFO insights from the PwC Pulse Survey.” (September 12, 2023). PwC https: //www.pwc.com/us/en/library/pulse-survey/business-reinvention/cfo.html